2024 1040 Schedule Se

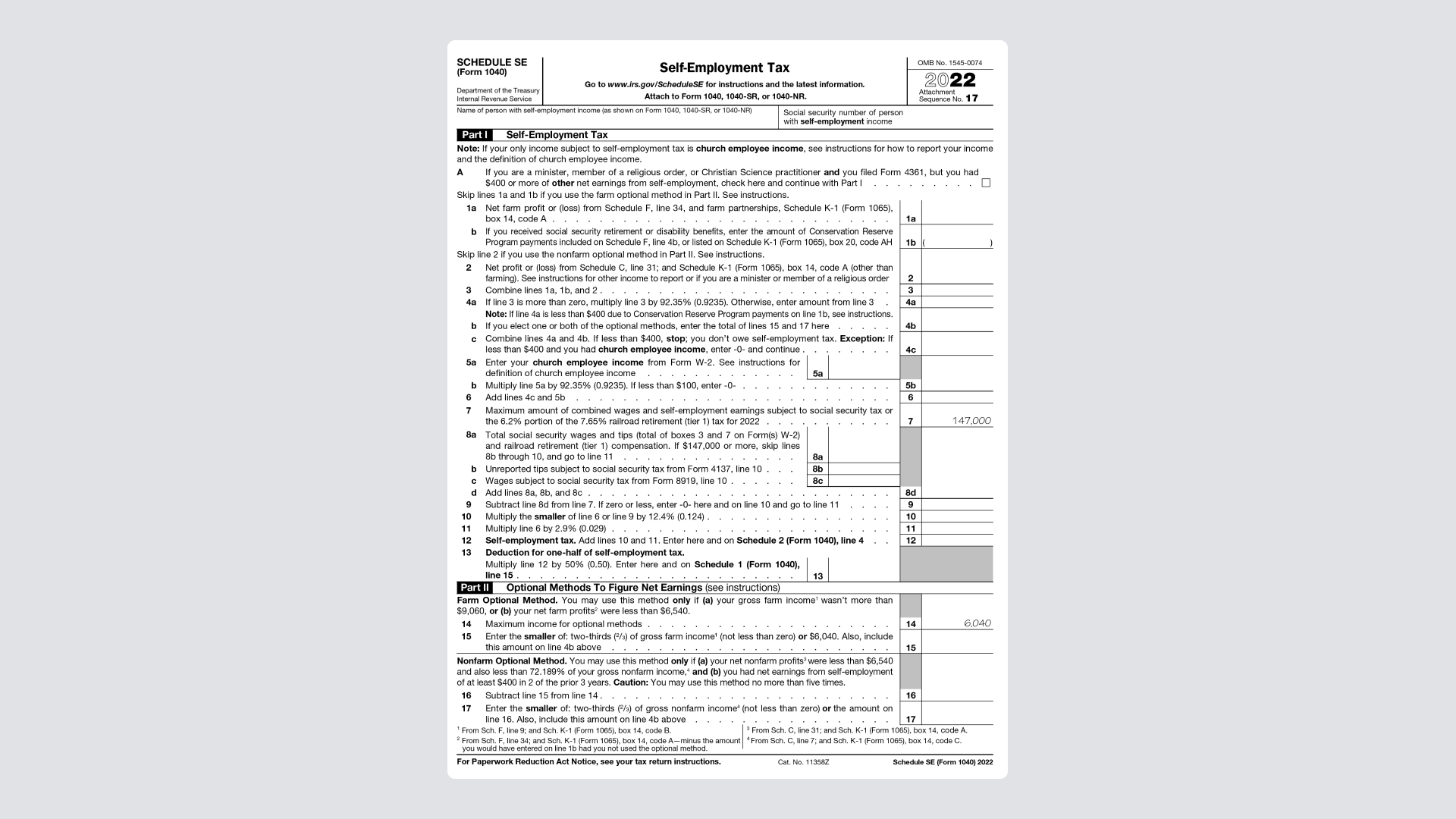

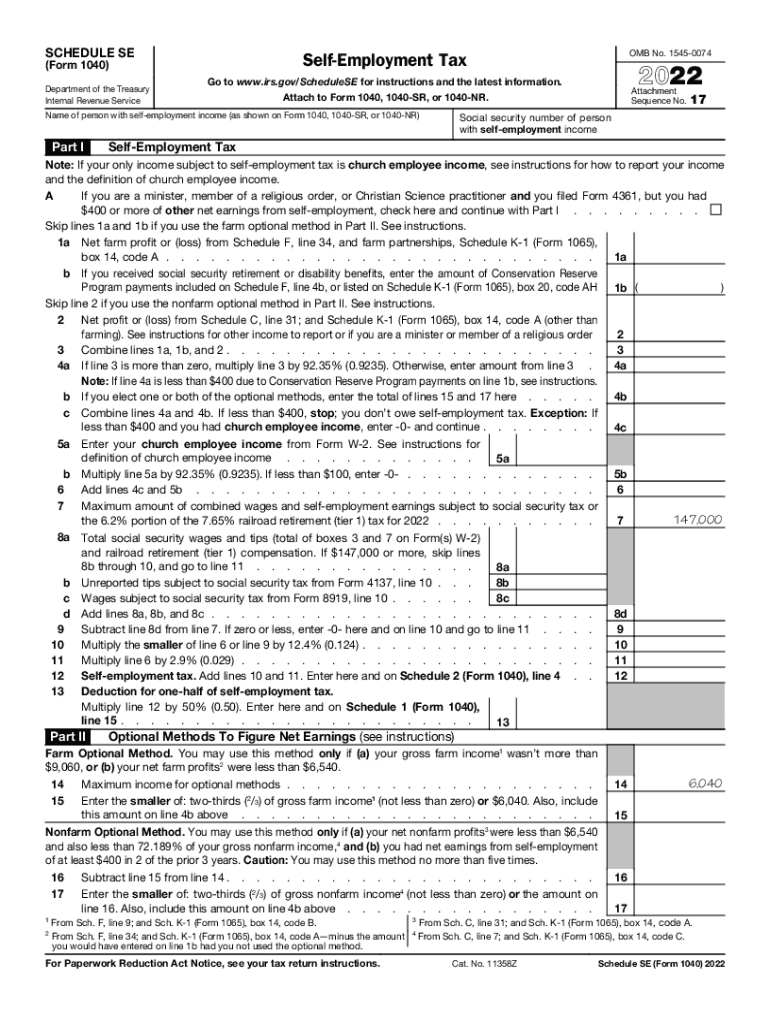

2024 1040 Schedule Se – Complete IRS form 1040 “Schedule C, Profit or Loss From Business.” Complete IRS Form 1040 Schedule SE, “Self-Employment Tax.” With these two forms, you are able to report your business . Sole proprietors may only need the form 1040, Schedule SE for self employment taxes, and Schedule C-EZ for reporting the year’s business profits. Larger businesses with employees, limited .

2024 1040 Schedule Se

Source : www.dochub.comA Step by Step Guide to the Schedule SE Tax Form

Source : found.comIRS Schedule SE (1040 form) | pdfFiller

Source : www.pdffiller.comSelf 2022 2024 Form Fill Out and Sign Printable PDF Template

Source : www.signnow.com2023 Form IRS Instruction 1040 Schedule SE Fill Online

Source : tax-form-1040-instructions.pdffiller.comAbout Schedule SE (Form 1040), Self Employment Tax | Internal

Source : www.irs.govIRS Instruction 1040 Schedule SE 2020 2024 Fill out Tax

Source : www.uslegalforms.comTax Season Resources for Your Business | Lili

Source : lili.coSelf employed taxes 2022: Fill out & sign online | DocHub

Source : www.dochub.comFreelancers Union on X: “If you’re even a moderately successful

Source : twitter.com2024 1040 Schedule Se 2023 1040 schedule se: Fill out & sign online | DocHub: The return must include a Schedule SE, which you use to calculate how much self-employment tax you owe. However, when you are filling out your 1040, the IRS allows you to deduct a portion of the . Free version available for Form 1040 and limited credits only How it works: So, for example, if your Schedule SE says you owe $2,000 in self-employment tax for the year, you’ll need to .

]]>