2024 Home Office Deduction Schedule C Instructions

2024 Home Office Deduction Schedule C Instructions – But can the remote work setup also include tax deductions on your home office space? It depends. The biggest WFH tax deduction is arguably the home office deduction, and according to CNBC . If you itemize your deductions via Schedule A rather than claiming the standard deduction, you could be eligible for one or more home-related tax breaks. And if you work from home, you might be able .

2024 Home Office Deduction Schedule C Instructions

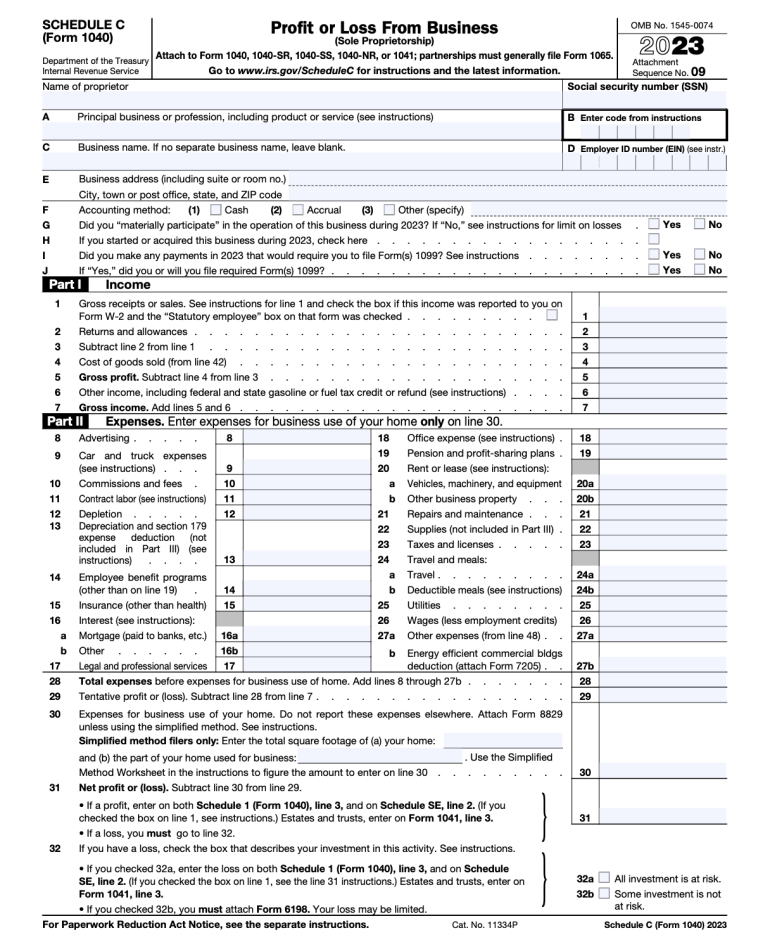

Source : www.nerdwallet.com2023 Instructions for Schedule C Profit or Loss From Business

Source : www.irs.govSchedule C Instructions [with FAQs]

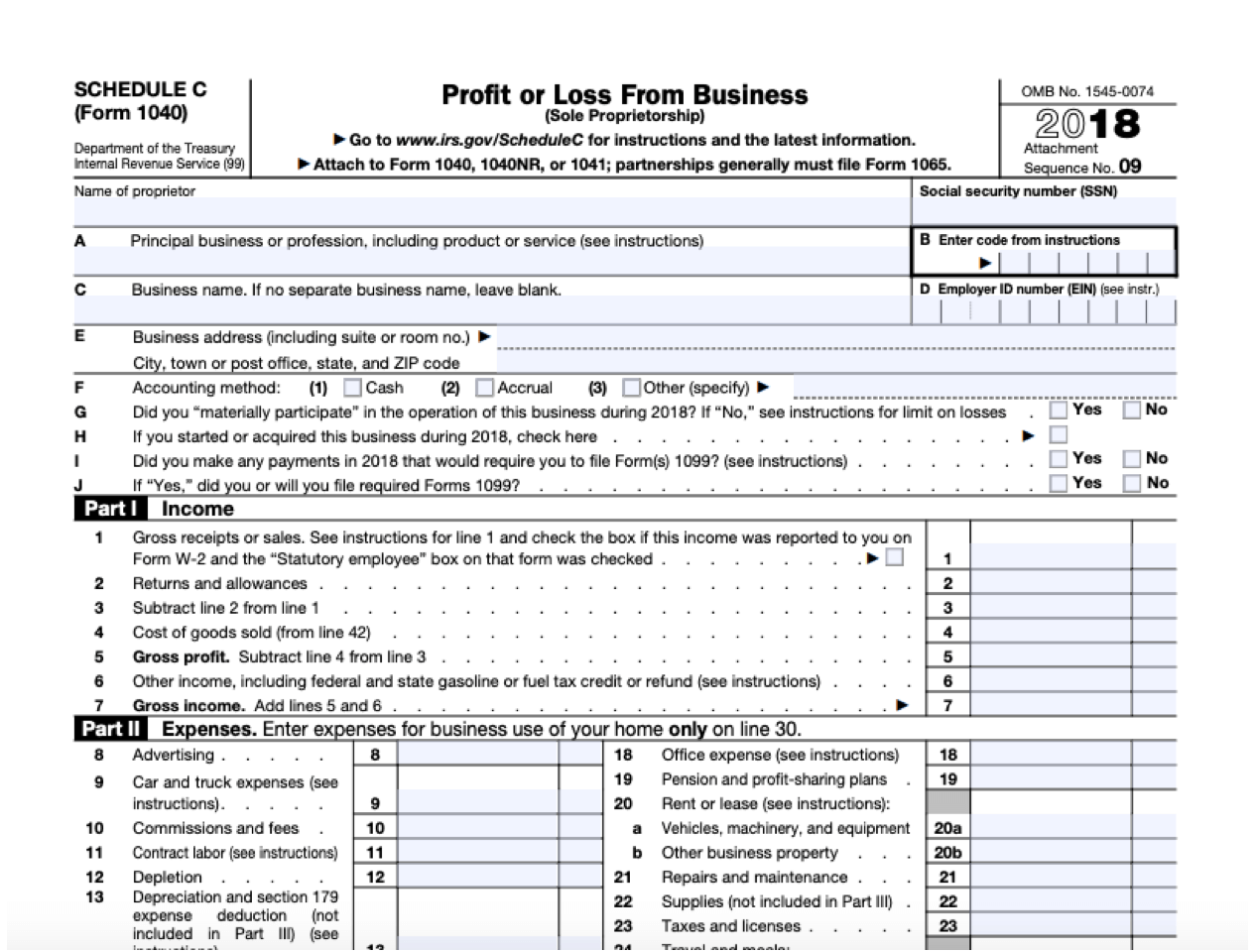

Source : www.thesmbguide.com2022 schedule c: Fill out & sign online | DocHub

Source : www.dochub.comx raw image:///bb5fe082e918aa3e8d3a083445b77ad9f93

Source : www.irs.govForm 2106: Employee Business Expenses: Definition and Who Can File

Source : www.investopedia.comFiling a Schedule C For An LLC | H&R Block

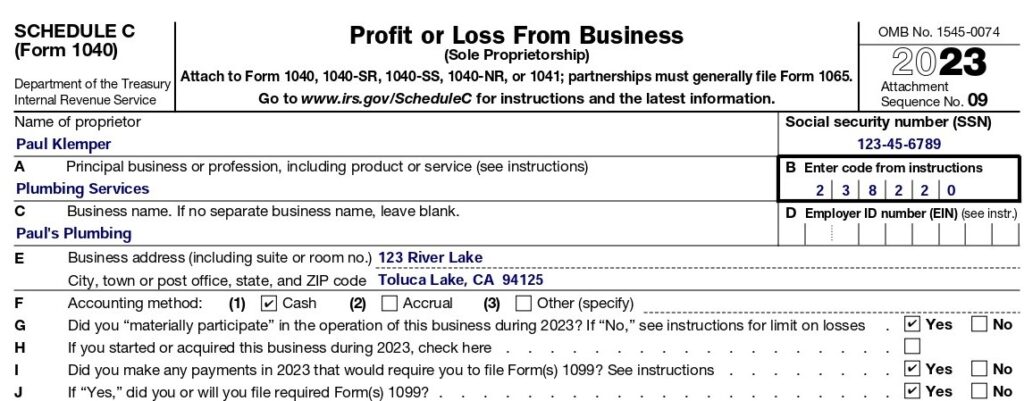

Source : www.hrblock.comHow To Fill Out Schedule C in 2024 (With Example)

Source : fitsmallbusiness.comFiling a Schedule C For An LLC | H&R Block

Source : www.hrblock.comWhat Is Form 1040 X? Definition, Purpose, and How to File

Source : www.investopedia.com2024 Home Office Deduction Schedule C Instructions What Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet: Top tax write-offs for the self-employed The home office Schedule 1. If you are self employed and pay for your own health insurance, you may be able to deduct the cost of the premiums. This . The standard deduction has risen substantially in the past decade. According to the Congressional Budget Office, before 2017, 47 million Americans chose to itemize their deductions, but President .

]]>

:max_bytes(150000):strip_icc()/Screenshot2024-01-12at4.04.42PM-6ae67168a2a848849de8750450dab1af.png)

:max_bytes(150000):strip_icc()/1040xtop-d338e5af0027469aa2b5e1d7c0f2c909.png)